How Does My Credit Score Impact Instant Credit Card Approval

- Mudra K

- May 28, 2024

- 2 min read

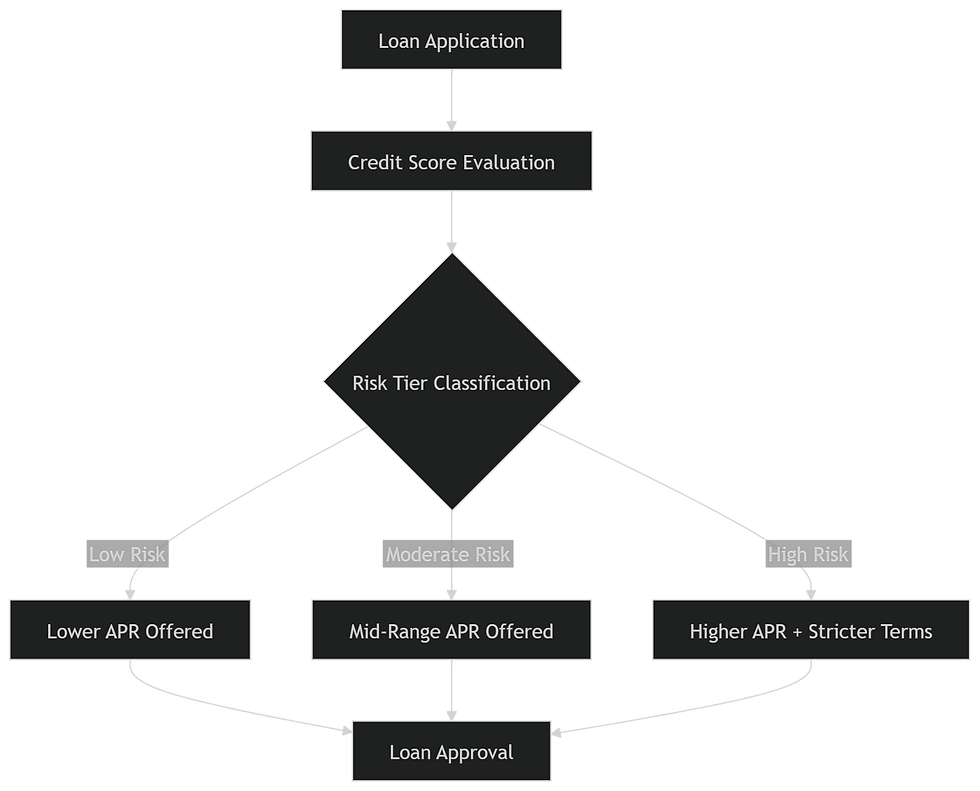

Here's how your credit score influences the approval process for instant credit cards:

Credit Score Importance: Your credit score is a crucial factor that lenders consider when evaluating your application for an instant credit card. A high credit score indicates responsible credit management and financial stability, making you a more attractive candidate for instant approval.

Quick Approvals for High Credit Scores: Banks prioritise individuals with high credit scores as prime customers, leading to quicker approvals for those with scores exceeding 750. A good credit score demonstrates your creditworthiness and reliability in managing credit, prompting lenders to approve your application swiftly.

Competitive Terms for High Credit Scores: Applicants with high credit scores are likely to receive more competitive interest rates, processing fees, and favorable terms on their instant credit cards. Lenders often offer better terms to individuals with excellent credit histories, resulting in cost savings and improved financial benefits.

Longer Loan Tenures for High Credit Scores: In addition to lower interest rates, banks may extend longer loan tenures to individuals with high credit scores. This combination of lower rates and extended repayment periods can lead to substantial savings and enhanced financial flexibility for cardholders.

Pre-Qualified Offers for High Credit Scores: If you have a strong credit score and an existing relationship with a bank, you may receive pre-qualified offers for instant credit cards. These pre-approved offers streamline the application process, from approval to disbursal, often taking only minutes for completion.

Impact of Low Credit Scores: Conversely, a lower credit score can result in higher interest rates, processing fees, and a more challenging application process. Individuals with lower credit scores may face obstacles in obtaining instant credit card approval, including potential rejection of their application.

In summary, your credit score significantly influences the approval process for instant credit cards. A high credit score can lead to quick approvals, competitive terms, and favorable benefits, while a low credit score may result in higher costs, a more complex application process, and potential rejection. Managing your credit responsibly and maintaining a good credit score can enhance your chances of instant credit card approval and unlock the benefits of financial flexibility and empowerment.

Comments