Key Features of GoodScore App | Top 10 Benefits for Credit Awareness

- Mudra K

- Apr 5, 2025

- 4 min read

Updated: Apr 13, 2025

🔍 Introduction

In an age where your credit score defines your financial power, having a reliable credit monitoring tool is essential. One app that has recently caught the attention of Indian users is the GoodScore App. With its focus on simplicity, security, and user empowerment, it stands out among other credit score apps.

If you're wondering why people are switching to GoodScore, this blog explores the key features and benefits of using this app to monitor your credit health.

📱 What is the GoodScore app?

GoodScore is a mobile-based credit monitoring tool available on Android and iOS. It enables users to check their credit score, understand the factors affecting it, and get actionable advice to improve their financial profile—all for free.

This app can significantly improve your credit history, whether you're applying for a loan, credit card, or simply want to establish a solid credit history.

💡 Why Monitoring Your Credit Score Matters

A good credit score opens doors to:

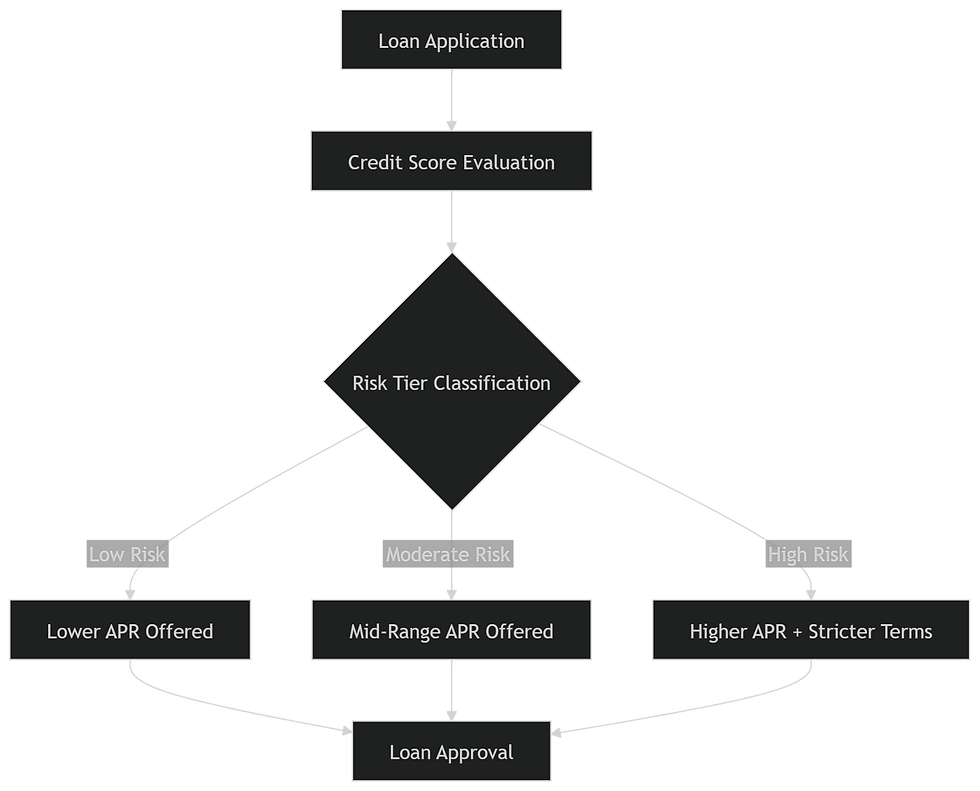

Lower interest rates

Higher chances of loan approval

Better credit card offers

Stronger financial reputation

Using an app like GoodScore makes it easier to stay aware of your credit position and take steps to maintain or improve it.

⭐ Key Features of the GoodScore App

Let’s explore the core strengths that make GoodScore App a reliable choice:

✅ 1. User-Friendly Interface

Minimalist, clean UI

Smooth navigation with intuitive menus

Great experience even for non-tech-savvy users

✅ 2. Free Credit Score Checks

Allows you to check your CIBIL score absolutely free

Monthly refresh ensures up-to-date insights

No need to pay or upgrade for basic credit score tracking

✅ 3. Detailed Credit Report Analysis

Access to your complete credit report in seconds

See all active accounts, credit inquiries, and repayment history

Easy-to-understand breakdown with color-coded segments

✅ 4. Personalized Credit Tips

AI-driven insights based on your report

Suggestions to improve score: reduce utilization, pay dues, limit inquiries

Step-by-step guidance for new users

✅ 5. Smart Notifications

Timely alerts on score changes, late payments, or new inquiries

Helpful reminders to maintain credit health

No spam—only useful notifications

✅ 6. Data Security & Privacy

Encrypted login with OTP and biometrics

AES-256 level data encryption

Never shares your data with third parties without consent

✅ 7. Ad-Free Experience

Unlike many credit apps, GoodScore offers a completely ad-free experience

No loan push notifications or insurance pop-ups

✅ 8. Comparative Credit Analysis

See how your credit profile compares with users of similar age/income

Helps set realistic credit improvement goals

✅ 9. Financial Tools Integration

EMI calculator, loan eligibility checker, and budgeting tools built-in

Helps plan financial decisions based on your current credit position

✅ 10. No Impact on Score

All cheques are soft inquiries, meaning they don’t lower your credit score

📊 How GoodScore Compares to Other Apps

Feature | GoodScore | OneScore | PaisaBazaar | CreditMantri |

Free Credit Score | ✅ | ✅ | ✅ | ✅ |

Ad-Free Experience | ✅ | ✅ | ❌ | ❌ |

CIBIL Score Access | ✅ | ✅ | ✅ | ✅ |

Personalized Tips | ✅ | ✅ | ✅ | ✅ |

Financial Tools | ✅ | ❌ | ✅ | ✅ |

Official Credit Bureau Partner | ✅ | ✅ | ✅ | ✅ |

👥 Who Should Use GoodScore?

GoodScore App is ideal for:

Salaried individuals planning for a home loan or car loan

Freelancers or self-employed users with variable income

College students and new earners building their first credit history

Anyone looking to boost their financial literacy

❓ FAQs About GoodScore App

1️⃣ Is the GoodScore app free to use?

Yes, it offers completely free credit score checks and credit reports without hidden charges.

2️⃣ Does checking my score on GoodScore affect it?

No, the app performs soft enquiries which do not impact your score.

3️⃣ Is GoodScore safe?

Absolutely. It uses bank-grade encryption and follows strict privacy protocols.

4️⃣ Can I improve my credit score with GoodScore?

Yes. The app provides personalized tips based on your credit report for improvement.

5️⃣ How often should I check my score?

You should check your credit score at least once a month to stay informed.

6️⃣ Which credit bureau does GoodScore use?

Currently, GoodScore pulls reports from CIBIL, one of India’s leading credit bureaus.

Is the GoodScore app RBI approved?

The GoodScore App is a credit monitoring tool that provides users with access to their credit scores and reports. It sources credit information from Experian and CRIF High Mark, two of the four credit bureaus authorised by the Reserve Bank of India (RBI) . While GoodScore utilises data from these RBI-authorised bureaus, the app itself is not directly approved or regulated by the RBI.

Understanding RBI Approval:

The RBI oversees and regulates financial institutions and credit bureaus in India. However, it does not individually approve or regulate third-party applications like GoodScore App that provide credit-related services. Instead, these apps operate by partnering with RBI-authorised credit bureaus to fetch and present credit information to users.

🎯 Conclusion

In today’s credit-driven world, GoodScore App stands out as a secure, insightful, and user-friendly tool to track and manage your credit score. With features like free score checks, in-depth credit analysis, and a no-spam interface, it’s a must-have app for anyone serious about their financial health.

👉 Whether you're a first-time borrower or a seasoned credit card user, GoodScore has something valuable to offer.

Comments